Market Research

Make digital lending investable

Exaloan leverages Big Data and Machine Learning to match institutional investors and global FinTech loan originators seamlessly with integrated risk management on a B2B marketplace.

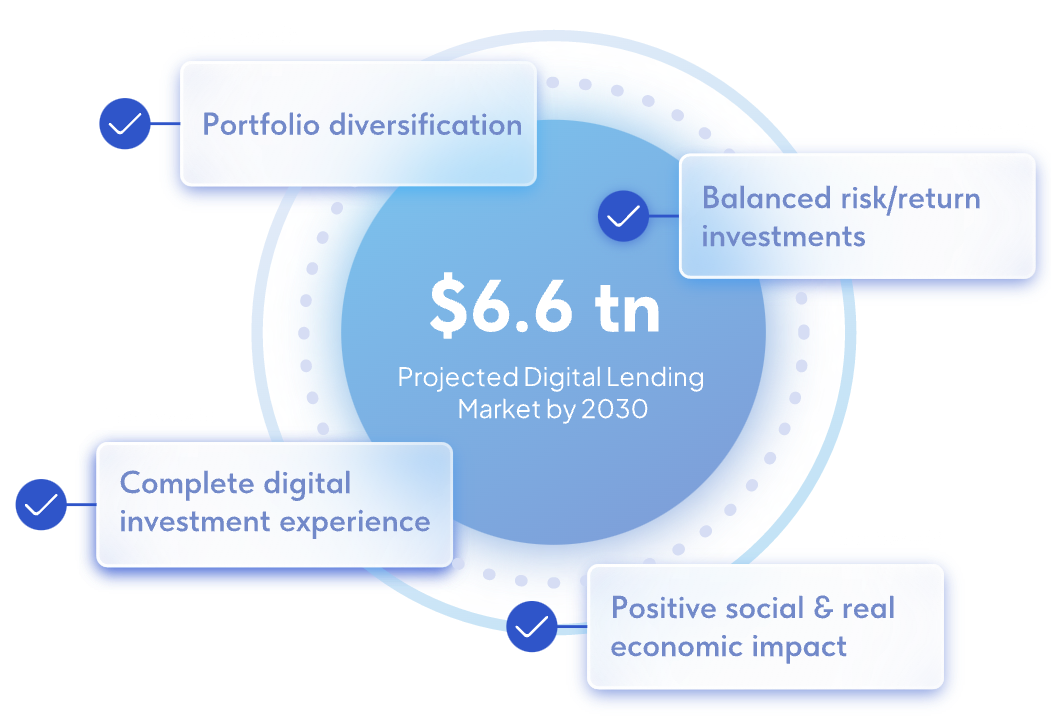

Why invest in digital lending?

Digital lending is the most dynamic growth segment within non-banking lending. Adding digital lending as an asset class can help diversify an investor’s traditional asset mix and improve investment performance.

What we offer

Find matching funding opportunities effortlessly

Exaloan makes digital lending investable.

We connect investors and loan originators seamlessly and match funding opportunities through unique loan-level, real-time credit scoring.

We connect investors and loan originators seamlessly and match funding opportunities through unique loan-level, real-time credit scoring.

Advanced ESG tool for financial market participants

Painlessly integrate the EU SFDR and other ESG regulations into your investment activities.

State of the art portfolio monitoring for investors

Get in-depth reporting on your existing investment portfolio.

Tools to grow for loan originators

Launch verified track record validation and risk analytics, including external credit scoring on your loan portfolio instantly.

Latest insights & news

Stay informed with our latest research, insights, and trends in the digital lending market.

Latest insights

News & Press

Digital Finance: Driving Financial Inclusion in Africa | Part 2