Digital Lending and FinTechs are Changing: The Impact on SME Lending

Recent technological advancements have completely changed the financial services value chain. Furthermore, the utilization of behavioural and psychometric information, as well as social media traces, has enabled various non-banking financial institutions (NBFCs) to bridge the funding gap, which still exists and FinTechs have started tackling it for the Micro, Small, and Medium Enterprises across the globe. FinTech has provided a hassle-free path to flexible and customized credit products by targeting niches in the SME lending sector.

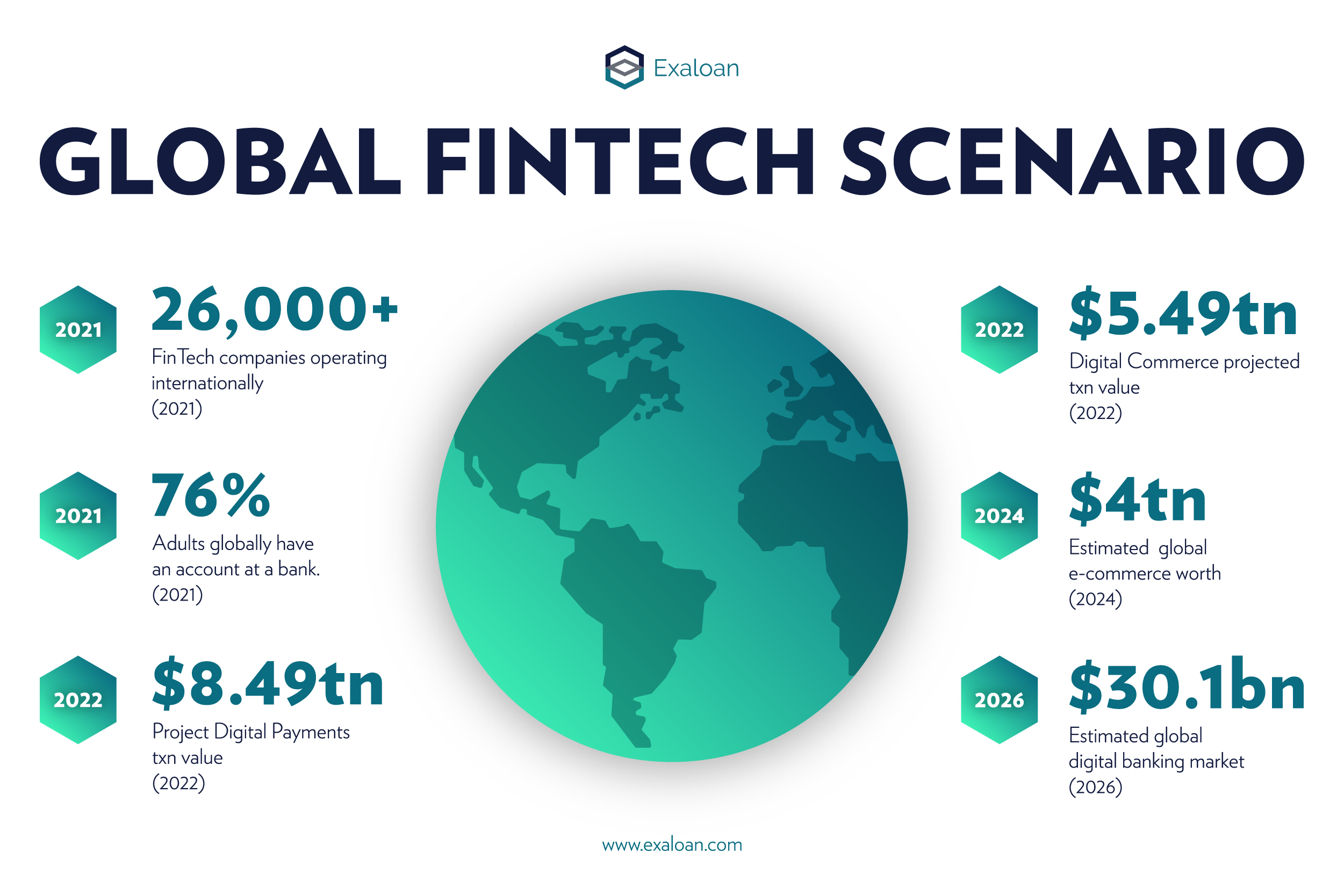

Use of Digital Payments (after Covid)

Banks have never been more diverse in terms of the products and services they provide to their clients. However, Banks must not lose sight of the fact that lending is critical to their profitability and relevance, as well as a foundation for attracting and initiating deeper connections with clients. Lending can then serve as a launching pad for a bank to offer a broader ecosystem of financial and non-financial services including networking/access to markets and recognition, information and educating the customers.

Opportunities for Banking sector in SME lending scenario

Banks may seize new opportunities with SMEs and gain a larger share of the projected growth by reinventing and modernizing their business-lending procedures. Banks, on the other hand, face issues in the SME lending market since many continue to utilize outdated business models, rely on legacy systems, and regard SMEs as corporate entities.

- Increased conversion rates result in a 10% to 15% increase in revenue.

- Gains in operational efficiency of 20 to 30 percent as a result of digitizing the customer journey and reducing touch-time.

- Reduced the risk of nonperforming loans (NPLs) by 10% to 25% by improving risk models and employing analytics to make automated choices.

The SME sector, which contributes significantly to GDP, exports, and jobs, continues to play an important role in driving growth. However, despite their demonstrated growth record and contribution to the economy, financial institutions have underserved SMEs. This circumstance occurs for a variety of reasons. Financial institutions consider the category as high risk due to its heterogeneity. The majority of enterprises are family-owned, and promoters prefer funding from unorganized sources at exorbitant rates. Inadequate credit history inhibits banks’ capacity to assess such units’ credibility. Banks face challenges due to poor record keeping and financial planning.

Fintech's Changing Face

Fintech is no longer only a disruptor; it is assisting SMEs in becoming more bankable by alleviating critical pain points such as quick access to credit. It is making inroads into the financial services business as an innovator and enabler, with the financial muscle to bear the risk of loans and recoveries. Fintech lenders, having a technology advantage and free of legacy baggage, are acquiring a competitive advantage over traditional banks. The statistics are telling:

- 67% of traditional financial institutions are already feeling the heat

- 84% of traditional financial institutions are embracing disruption

- 95% of traditional financial institutions are expected to increase fintech partnerships in the next 3 to 5 years

Final words

Digital lending and fintech are transforming the SME finance landscape. Banks are trying to adopt the digital environment and automating backend activities to reap both short- and long-term benefits but still there is a long way to go. End-to-end digitization will not only help banks reduce decision turnaround times but will also reduce the processing costs associated with lending to these borrowers. This will not only give prompt access to funds but will also reduce the cost of these loans. Financial institutions are experimenting with robotics, blockchain, artificial intelligence, big data, and analytics. New-age fintechs like Exaloan AG has potential to revolutionize the SME finance landscape. With its innovation and new-age products such as Loansweeper, which provides access to millions of investable loans operated by verified lending platforms.It brings transparency and standardization across the industry and assist in real-time decisions making, thus also enabling institutional investors reaching out to the underserved SME clients. These technologies enable banks to transition from traditional collateral-based funding methods to enhanced cash-flow lending. Some reputable FinTechs offer services such as converting scanned financial bank statements into customized formats for quick decision-making and offering borrowers digital platforms for easy access to funding. Banks and fintech will need to collaborate to provide customized digital products while also guaranteeing that the majority of SMEs can benefit from traditional lending channels.

About Exaloan

Exaloan is the leading technology provider for institutional investments in digital loans. Its mission is to close the global funding gap for individuals, entrepreneurs and SMEs by connecting institutional capital with digital lending platforms. By operating a global B2B marketplace, the company opens up digital lending as a new asset class. As an independent agent and validator, Exaloan provides a fully digital investment infrastructure with a standardized risk assessment of each single loan through its Loansweeper™ platform. At the core of its business, Exaloan uses big data and predictive analytics to generate an independent real time credit analysis as well as dedicated insights and reporting for institutional investors, banks, and lending platform partners. Insights cover topics such as sustainability reporting, advanced portfolio analytics, and market research.

Behind Exaloan stands an experienced team with extensive know-how in the areas of quantitative portfolio management, capital markets, machine learning, and software development.