Digital Finance: Driving Financial Inclusion in Africa | Part 2

In one of our last blogposts, we begin discussing the impact of the global digital lending industry on financial inclusion, based on the example of Africa. In this blog post, we will go more into detail exploring the different variations and business models that fall under the umbrella of Digital Lending.

The Digital Lending Landscape | Sub-Saharan Africa

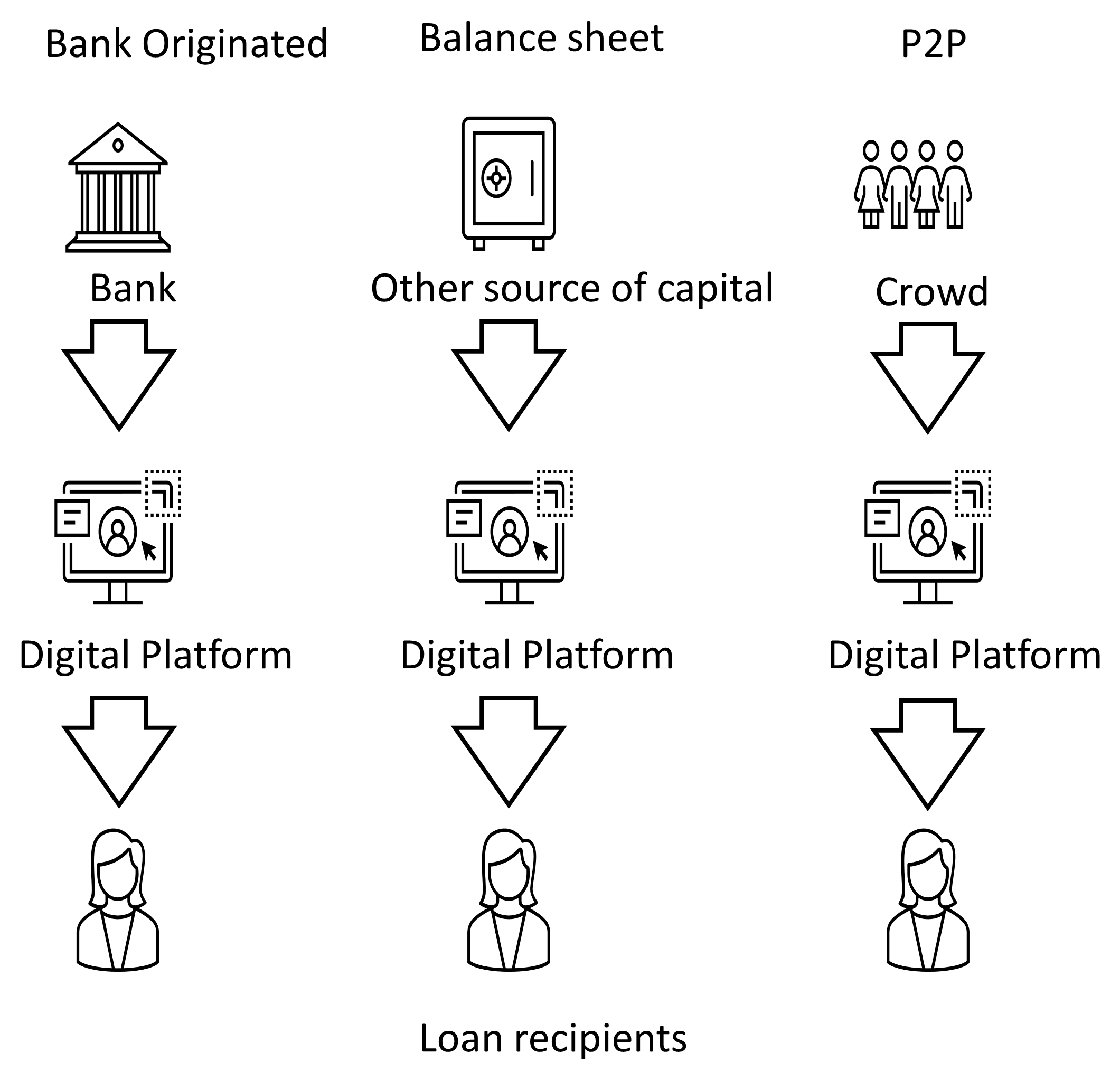

The visualization below shows three main lending models: Bank Originated Digital Lending, Balance Sheet Lending and Peer-to-Peer lending. We will explain these models based on their implementation in Africa and discuss how these models are linked to the development stage of the financial system and its African participants.

Source: based on FSI Insights on policy implementation No 27; Regulating fintech financing: digital banks and fintech platforms

Bank Originated Digital Lending entails banks partnering up with mobile service providers or startups to deliver their loans through digital channels. These offerings were the first to come to market, piggybacking off newly emerged mobile money systems and making use of established deposit-taking institutions. The first such lending scheme to emerge in Kenya was M-Shwari, a collaboration between the Commercial Bank of Kenya (CBK) and Safaricom, the provider of the M-Pesa mobile wallet. Bank-based digital lending is among the best-regulated form of digital lending in Africa since banks fall under the jurisdiction of local regulators.

Other players in the Sub-Saharan Digital Lending Ecosystem are Balance Sheet Lenders. They lend out proprietary funds acquired via capital or debt markets. This sector has grown significantly with notable players such as Branch and Tala, two Silicon Valley affiliated companies operating in Emerging Markets across the globe. Unlike banks these lenders do not take deposits and fall out of most of the traditional regulatory framework. These types of lenders have also been bogged down by controversy connected to the often extremely high interest rates that are not always communicated transparently to the borrowers (the Africa Report, 2021), prompting moves towards more regulatory scrutiny.

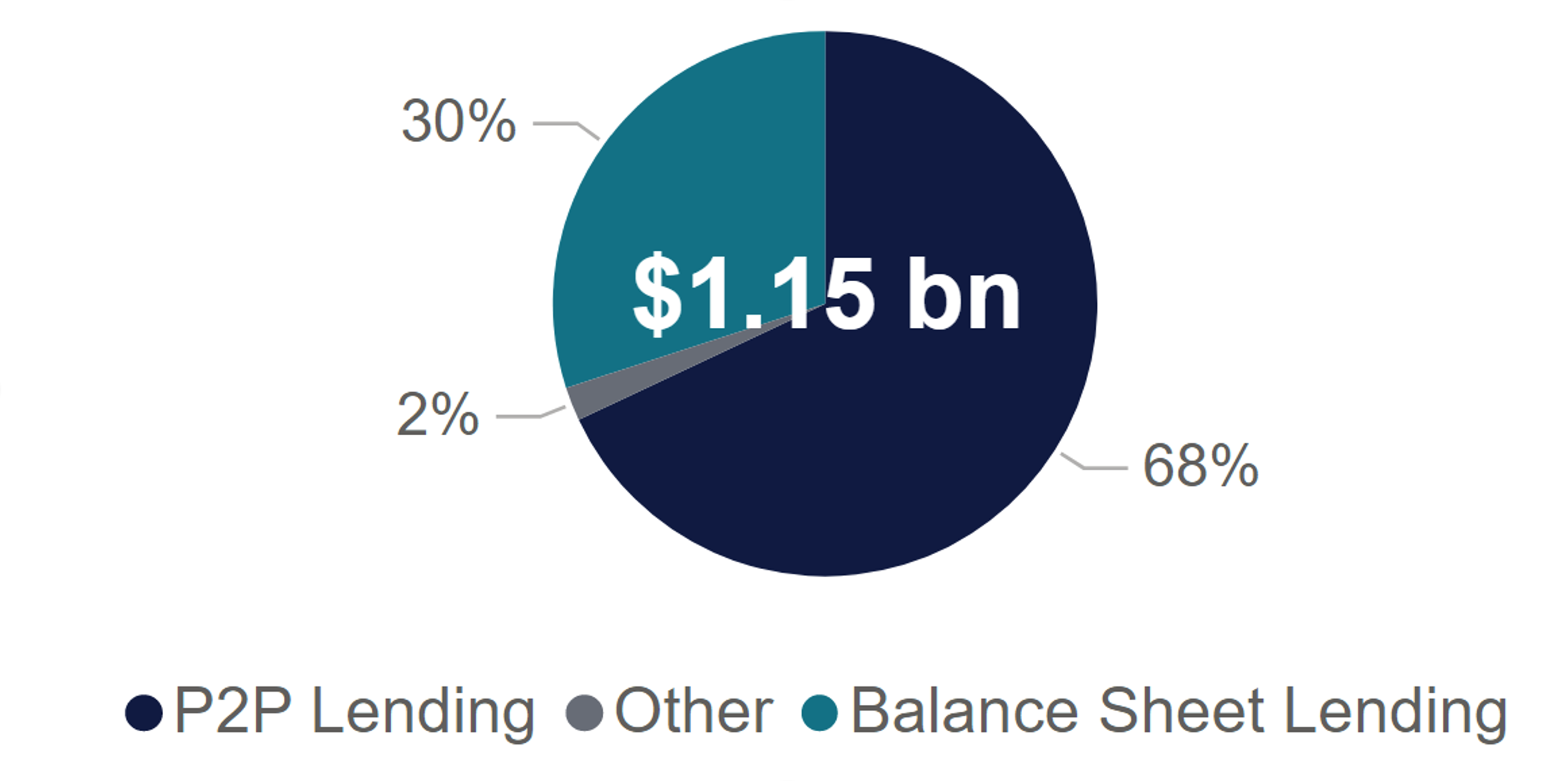

According to the 2nd Global Alternative Finance Market Benchmarking Report (2021), the global market share of Balance sheet consumer and business Lending in 2020 reached 36% of the estimated alternative finance loan volume, which amounted to more than 40 billion dollars.

Lastly the field of Peer-to-Peer Lending grew to become the dominant alternative lending model in Sub-Saharan Africa, reaching a total volume of 769 million in 2021, up by 50% from the previous year. A good example is Nigeria based Kiakia, which offers consumers both loans and investments. This field is however also quite dominant in the agricultural sphere, with offerings such as thriveagric or farmcrowdy allowing investors to finance the seeding stage which will be paid back with the harvest. In Sub-Saharan Africa P2P lending has become the dominant model in the alternative finance market.

The advantages of P2P lending are far-reaching: it does not only create more financing opportunities but also gives retail investors a good alternative to established asset classes, which are underdeveloped especially in the African context. It also enables to invest directly into the local economy. Most importantly perhaps, digital lending has proven to reach borrower segments that are excluded by traditional banks.

Market Share of Alternative lending products in Sub-Saharan Africa 2020

Source: The 2nd Global Alternative Finance Market Benchmarking Report (2021)

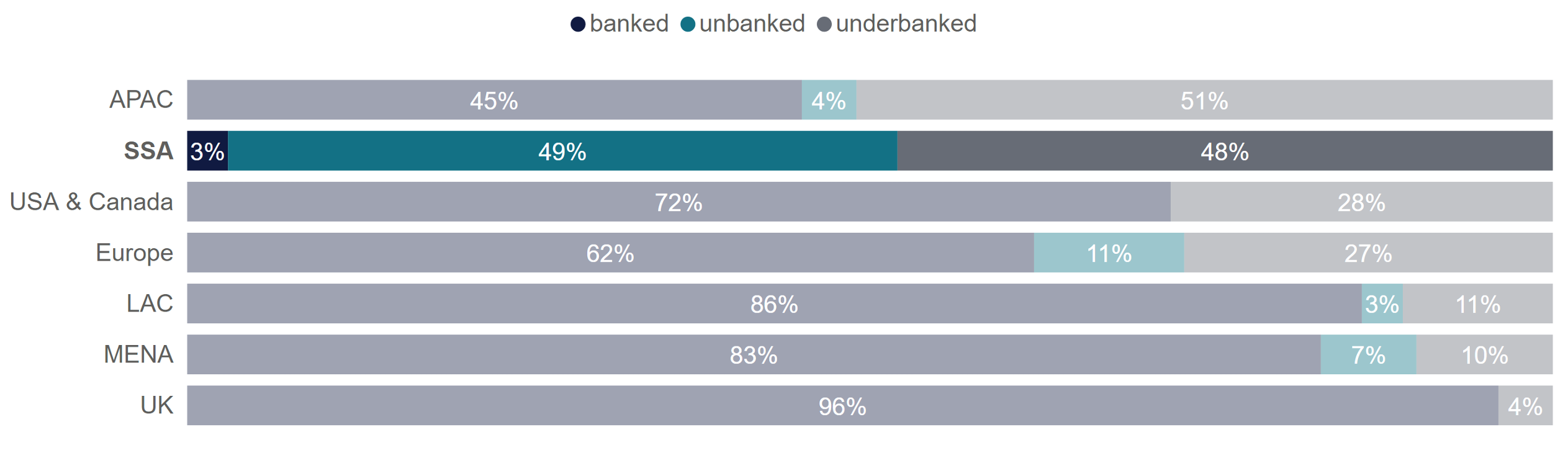

The advantages of P2P lending are far-reaching: it does not only create more financing opportunities but also gives retail investors a good alternative to established asset classes, which are underdeveloped especially in the African context. It also enables to invest directly into the local economy. Most importantly perhaps, digital lending has proven to reach borrower segments that are excluded by traditional banks.

Banking Status of Borrowers from Digital Lending Platforms across Regions (2020)

Source: The 2nd Global Alternative Finance Market Benchmarking Report (2021)

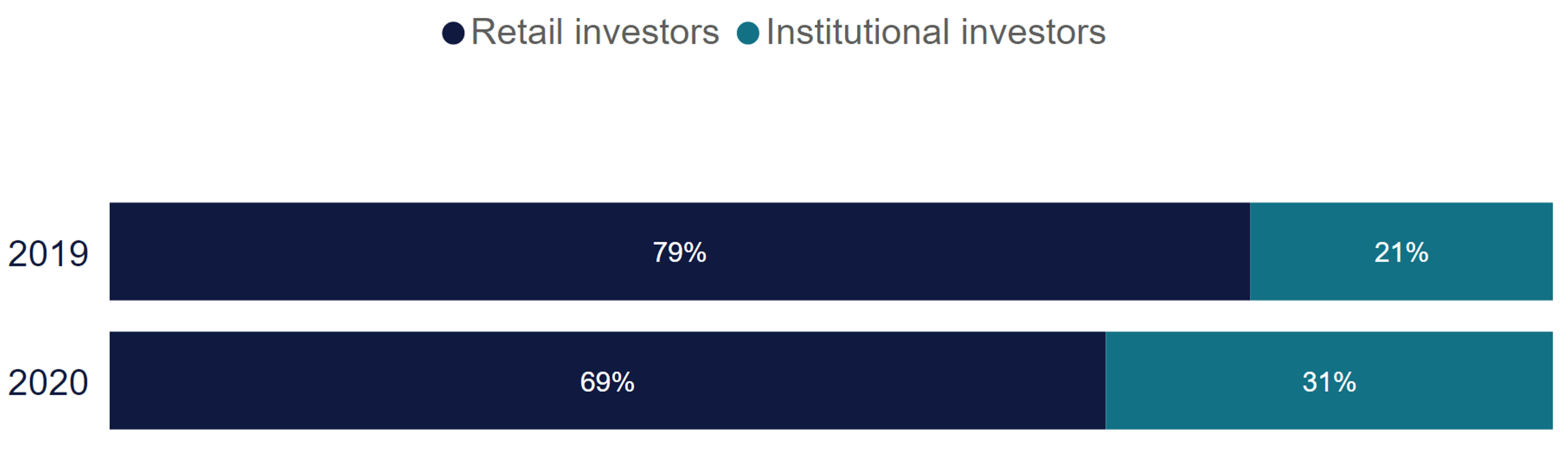

Currently relatively unconstrained by regulatory hurdles both balance sheet and peer-to-peer lending have shown double and even triple digit growth over the last few years. There are however still significant hurdles impeding market progress, most importantly a lack of transparency and comparability of the loan originators and the loans themselves. An investor willing to invest a large amount in the sector will invariably run into the problem that it is very difficult to assess the creditworthiness of companies and debtors from the outside. Furthermore, the availability of capital across lenders, but in particular in P2P lending, remains very limited. Nigerian lenders for example are currently only able to fund around 10% of eligible loans due to a lack of available funding. In 2020, the reported institutionalization rate on lending platforms stands at merely 30%. Although this is an increase compared to only 21% in 2019, bringing in cheaper money will likely be essential for sustainable growth.

Funding Source in Digital Lending in Sub-Saharan Africa 2020

Source: The 2nd Global Alternative Finance Market Benchmarking Report (2021)

In conclusion, new business models in digital lending hold great promise, especially in Africa, to improve financial inclusion. There are however still significant hurdles that need to be overcome before its full potential can be fulfilled.

At Exaloan we believe in the transformational power of technology to close the global financing gap. By providing a marketplace to connect Lending Platforms with Institutional Investors we aim to accelerate the transformation of the global financial lending markets toward more equitable and fair lending across the world – Including Africa.

About Exaloan

Exaloan is the leading technology provider for institutional investments in digital loans. Its mission is to close the global funding gap for individuals, entrepreneurs and SMEs by connecting institutional capital with digital lending platforms. By operating a global B2B marketplace, the company opens up digital lending as a new asset class. As an independent agent and validator, Exaloan provides a fully digital investment infrastructure with a standardized risk assessment of each single loan through its Loansweeper™ platform. At the core of its business, Exaloan uses big data and predictive analytics to generate an independent real time credit analysis as well as dedicated insights and reporting for institutional investors, banks, and lending platform partners. Insights cover topics such as sustainability reporting, advanced portfolio analytics, and market research.

Behind Exaloan stands an experienced team with extensive know-how in the areas of quantitative portfolio management, capital markets, machine learning, and software development.