Digital Finance: Driving Financial Inclusion in Africa

How digital Lending reaches previously underserved populations

Getting an overview over the fintech digital lending landscape can seem daunting and confusing, so we would like to use this blogpost to give an overview over the industry and how it has progressed in recent years based on its development in Africa.

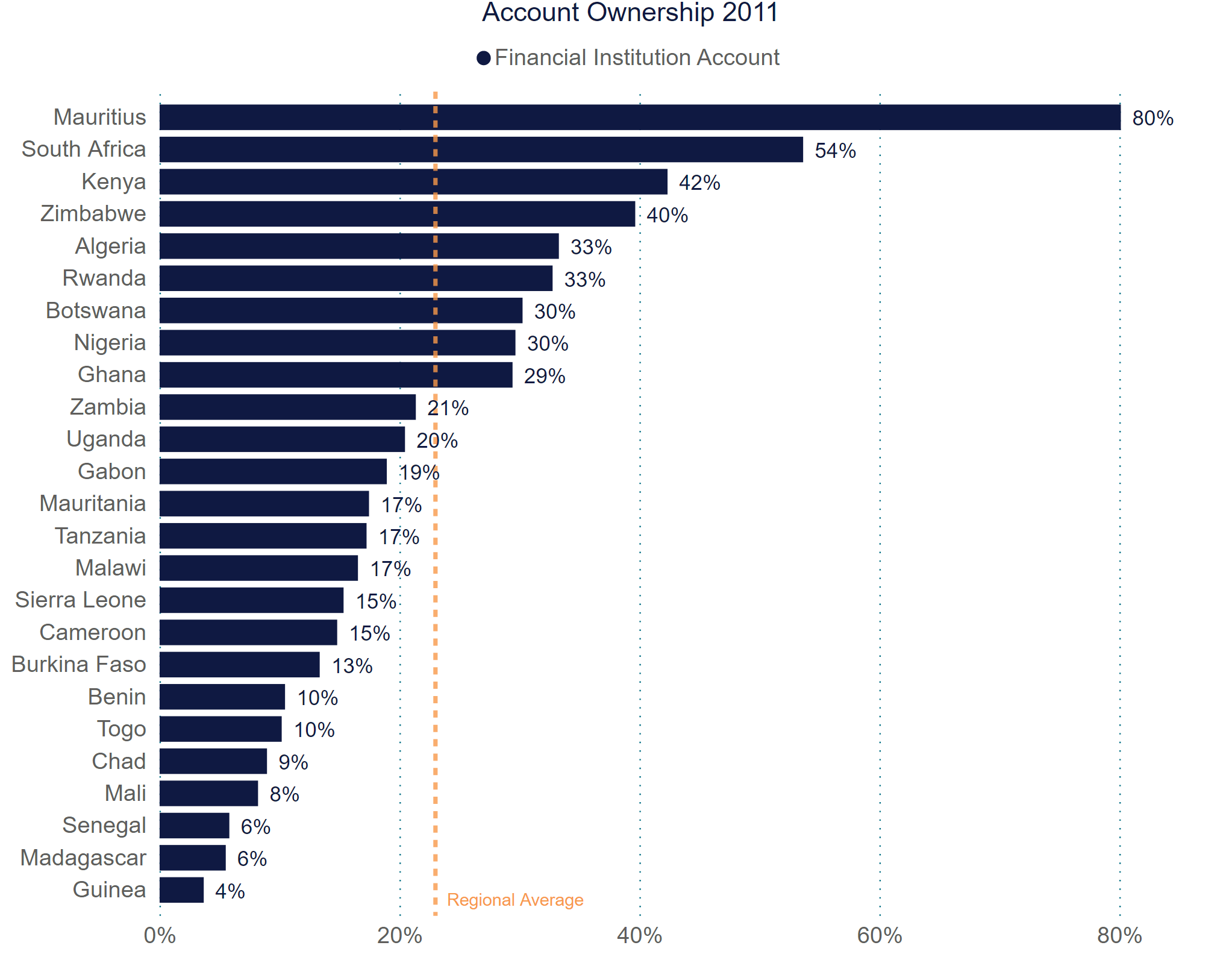

Traditional lending by banks comes with high barriers for entry that has historically excluded large parts of the population. This is especially true in Africa, where for the longest time most people did not even have a bank account to deposit and transfer money. As the graph below shows, most countries in sub-Saharan countries had financial inclusion rates of less than 50% in 2011.

2011: Account ownership at a financial institution or with a mobile-money-service provider (% of population ages 15+)

Source: Demirguc-Kunt et al., 2018, Global Financial Inclusion Database, World Bank, last accessed: 6/17/2021, own visualization

Note: the following countries have been excluded from the original visualization: Angola, Comoros, Djibouti, Burundi, and Sudan

Without formal employment or address and a credit history, traditional financial institutions are unwilling and unable to provide individuals or their informal businesses with credit. In developing economies, the first alternative lending models in the shape of microfinance institutions emerged in the 1970s. These institutions typically had a local focus and aimed to establish community-based lending behavior, that although it minimized default rates, was both high in costs and maintenance, and hardly scalable. As a result, thereof, large parts of the wider population in many countries remaining unbanked and without access to credit.

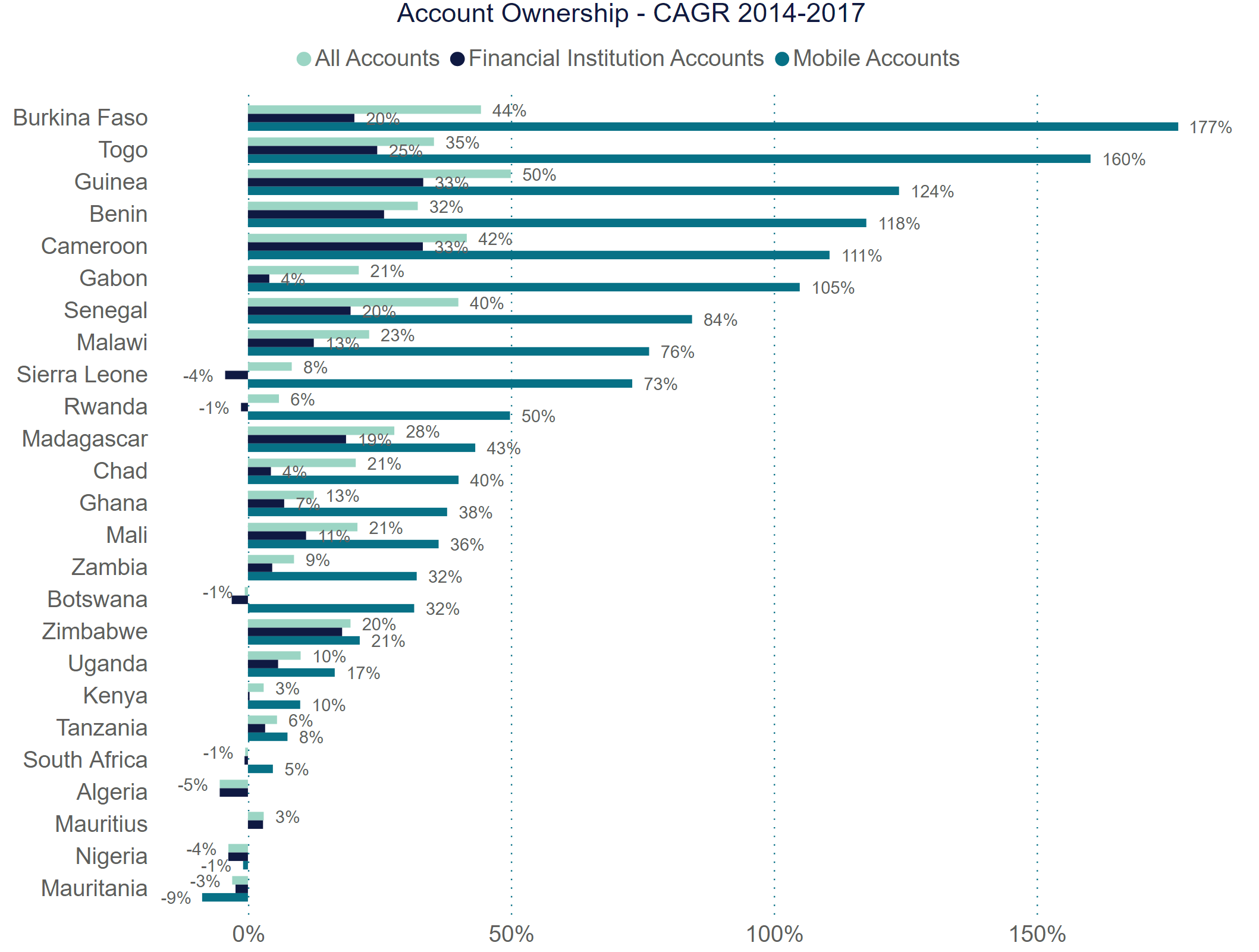

This only began to change with the emergence of mobile phone technologies in the 2010s. In the space of a few years the financial inclusion rate more than doubled in sub-Saharan Africa (Mastercard, 2020). With the introduction of M-Pesa in Kenya people suddenly had access to mobile wallets, first to send and receive money, but soon also to borrow. This development was not only limited to Africa: globally 1.2 billion adults have obtained an account since 2011, including 515 million since 2014. Between 2014 and 2017, the share of adults who have an account with a financial institution or through a mobile money service rose globally from 62% to 69%. In developing economies, the share rose from 54% to 63%. As the graph below shows, a large part of this growth was driven by mobile accounts, which grew disproportionately from 2014 to 2017 in many African countries.

Annualized growth of account ownership by type (% population age 15+)

Note: the following countries have been excluded from the original visualization: Angola, Comoros, Djibouti, Burundi, and Sudan

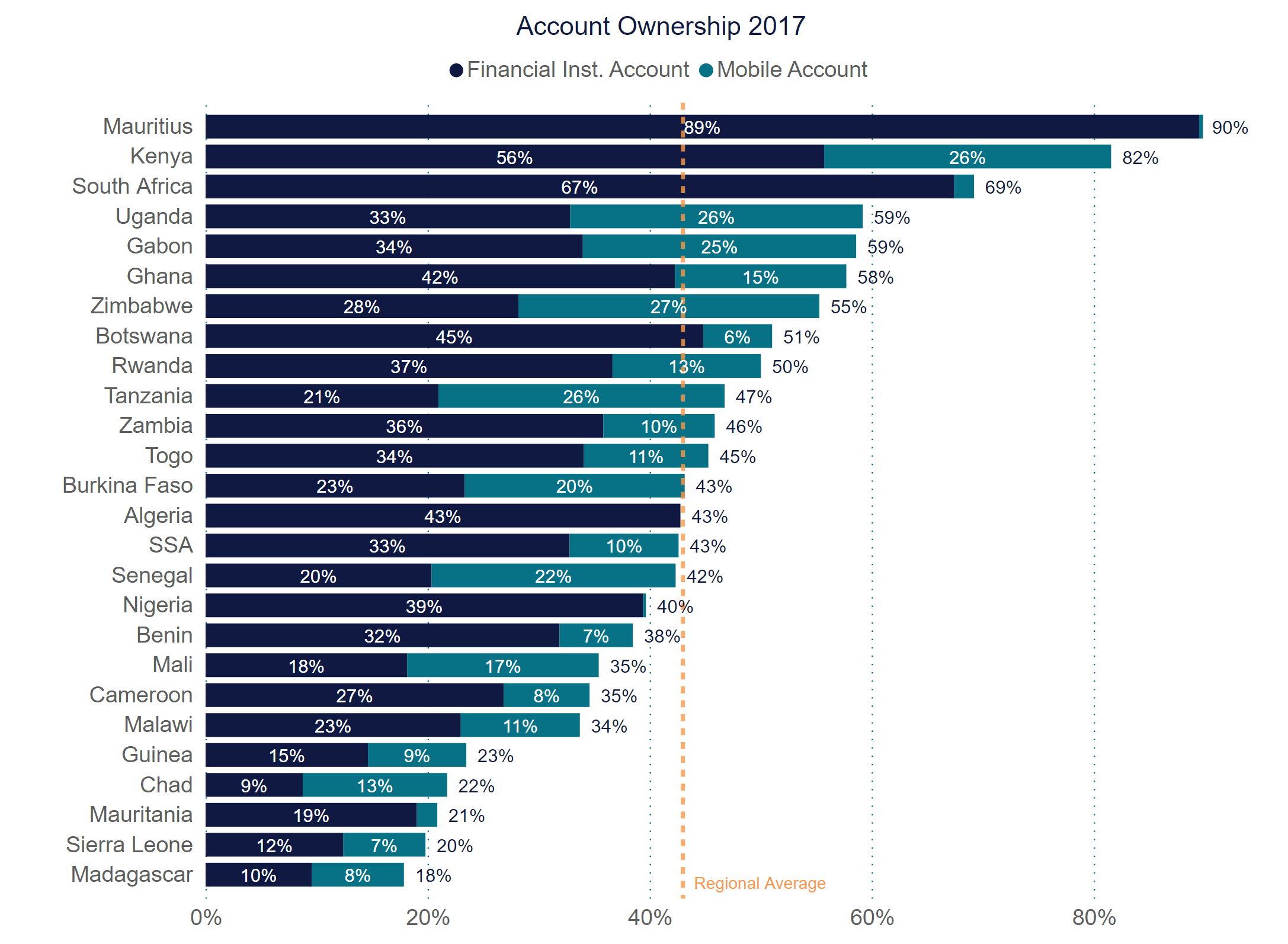

New companies sprang up to capitalize on this growing trend, using data collected by users’ mobile phones to calculate default probabilities. Consumers previously excluded from accessing capital had the ability to quickly borrow money in emergencies or to fund and grow their businesses. The visualization below breaks down the regional allocation of mobile money accounts as a percentage of all accounts in 2017. One of the main drivers in Sub-Saharan Africa has been Kenya, which is also the first country to propose specific legislation to regulate Digital Lending companies.

2017: Account ownership at a financial institution or with a mobile-money-service provider (% of population ages 15+)

Note: the following countries have been excluded from the original visualization: Angola, Comoros, Djibouti, Burundi, and Sudan

Digital Lending as described above includes a host of different types of companies and business models. However, all share one common hurdle. Digital lending processes ultimately require digital funding processes to bring that market to scale, and many platforms lack the appropriate funding sources to fulfill the demand for credit. This is where Exaloan comes in by standardizing and automating digital funding processes for institutional investors and digital lending partners. If you are interested to know more, send us an email at info@exaloan.com and request a meeting or a demo.

Related market research:

Digital Finance: Driving Financial Inclusion in Africa | Part 2

About Exaloan

Exaloan is the leading technology provider for institutional investments in digital loans. Its mission is to close the global funding gap for individuals, entrepreneurs and SMEs by connecting institutional capital with digital lending platforms. By operating a global B2B marketplace, the company opens up digital lending as a new asset class. As an independent agent and validator, Exaloan provides a fully digital investment infrastructure with a standardized risk assessment of each single loan through its Loansweeper™ platform. At the core of its business, Exaloan uses big data and predictive analytics to generate an independent real time credit analysis as well as dedicated insights and reporting for institutional investors, banks, and lending platform partners. Insights cover topics such as sustainability reporting, advanced portfolio analytics, and market research.

Behind Exaloan stands an experienced team with extensive know-how in the areas of quantitative portfolio management, capital markets, machine learning, and software development.