Does Digital Lending Add Value to an Investor’s Asset Mix?

*If you would like to read the full research paper, or find out more about how we enable institutional investors to tap into the digital lending market, click the button!

In this post, we take a closer look at why digital lending and private debt receive so much attention and whether it might be a good idea for institutional investors to have a closer look at this space (Spoiler alert: yes, it is).

Market Data and A Lot of Number Crunching

Since the digital lending market is still relatively young and not standardized, a benchmark index with a long data history is unfortunately not readily available (Spoiler alert #2: we are working on it). For now, we turned to academic research and number crunching. Following the methodology in “The Components of Private Debt Performance” proposed by Giuzio et. al. in 2018 in the Journal of Alternative Investments, we approximated the returns in digital loans on the basis of European bank lending rates. (We will shed more light on the method behind our madness in another post).

Visualizing Our Results: Digital Lending Is an Interesting Piece in the Asset Allocation Puzzle

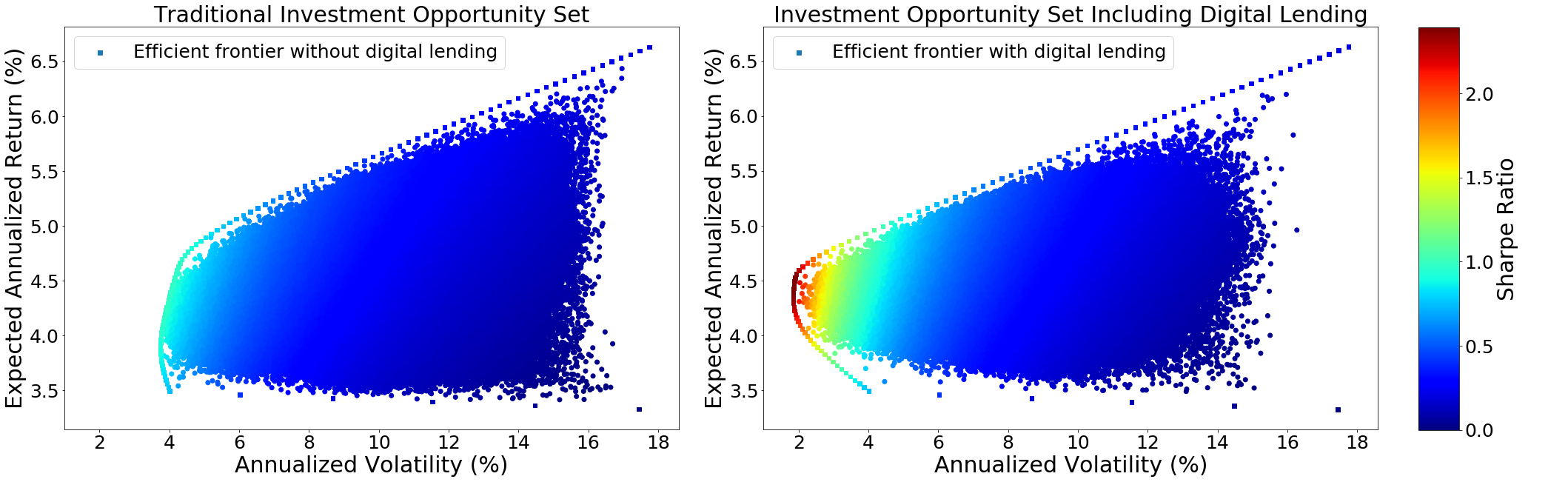

To build the opportunity sets, we created all allocations using no-leverage assumptions & no-short-selling constraints. We also constructed the respective efficient frontiers and color-coded the Sharpe Ratio of each individual portfolio for better comparability. The results we get when constructing portfolios with varying allocations using the traditional asset classes are displayed on the left in Figure 1. On the right-hand side, digital loans are added to the mix.

Figure 1: Results with traditional assets vs. Results when adding Digital Loans

The color scale on the far right indicates the value of the Sharpe Ratios (red = high, blue = low). The results show that adding digital loans to a traditional asset mix can significantly improve the investment opportunity set as evidenced by the higher Sharpe ratios of portfolios that can be constructed. For simplicity, the risk-free rate is set to 0 in all our calculations. The results indicate that adding digital loans can help diversify an investor’s traditional asset mix, and improve investment performance. Part of the result can be explained by the low correlation of digital lending to traditional asset classes.

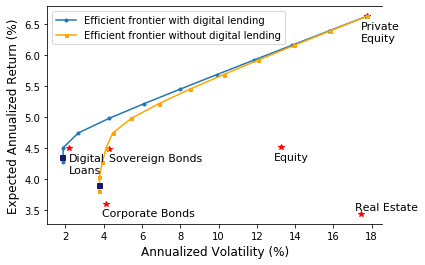

For a better display, we also contrast the different opportunity sets without the noise from the individual portfolios. You can see our calculated efficient frontier in Figure 2. The direct comparison shows that the efficient frontier including digital loans clearly dominates the attainable results without digital lending.

Our findings show that adding digital loans to a portfolio could be an interesting new way for investors looking to diversify their portfolio holdings, particularly given the backdrop of a low yield environment.

Exaloan is working on standardizing and automating digital loan investments for institutional clients across the globe. We are convinced that digital lending is a highly interesting and impactful emerging new asset class and with studies like these we hope to invite more interested parties to our dialogue.

As mentioned, we will dive deeper into the return construction for digital loans in one of our next posts. Follow us to stay up to date.

About Exaloan

Exaloan is the leading technology provider for institutional investments in digital loans. Its mission is to close the global funding gap for individuals, entrepreneurs and SMEs by connecting institutional capital with digital lending platforms. By operating a global B2B marketplace, the company opens up digital lending as a new asset class. As an independent agent and validator, Exaloan provides a fully digital investment infrastructure with a standardized risk assessment of each single loan through its Loansweeper™ platform. At the core of its business, Exaloan uses big data and predictive analytics to generate an independent real time credit analysis as well as dedicated insights and reporting for institutional investors, banks, and lending platform partners. Insights cover topics such as sustainability reporting, advanced portfolio analytics, and market research.

Behind Exaloan stands an experienced team with extensive know-how in the areas of quantitative portfolio management, capital markets, machine learning, and software development.